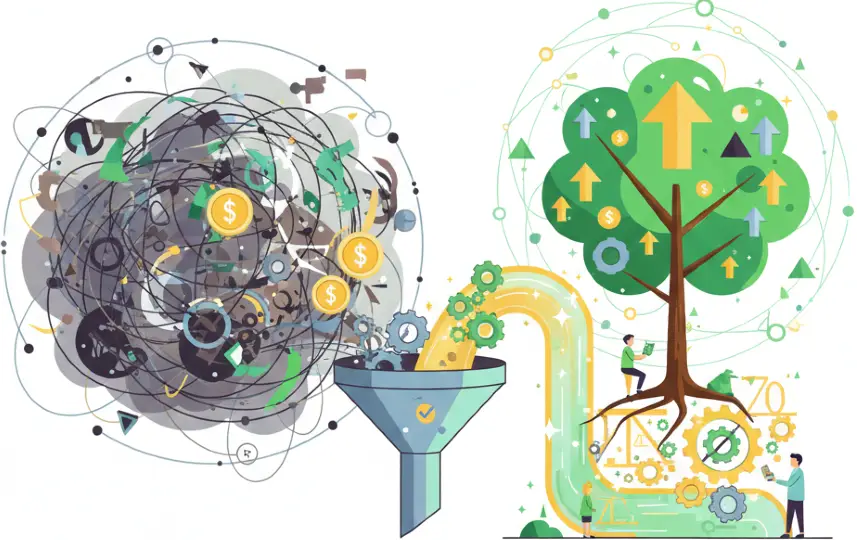

In today’s fast-moving and competitive world, a company’s ability to handle its money wisely is the secret to staying alive and becoming successful. While people usually focus on making more sales, a company’s true health often depends on how well it manages its spending and keeps its operations simple and efficient. Saving money isn’t about being cheap or making scary cuts; it is a smart, never-ending cycle of finding waste, fixing slow processes, and putting resources into the things that matter most. Building a “lean” business requires careful planning, getting every employee involved, and being ready to try new, innovative ideas.

Managing costs isn’t a one-time chore. The best plans look at every part of the business, from buying supplies and making products to advertising and hiring. Great companies see smart spending as a “superpower” they use all the time, not just when the economy is bad. This guide will show leaders how to build a plan for saving money, create a culture where people are careful with resources, and strengthen the company’s bank account so it can grow for a long time.

Using Data: The Best Way to Start

No money-saving plan works unless the company truly understands where its cash is going. This means doing more than just glancing at a bank statement; it requires a deep dive into every expense. Think of it like a doctor’s check-up: the business must record every cost—both the ones that stay the same and the ones that change—and ask, “Do we really need this?” By doing this, a business can spot hidden waste and find easy ways to save.

The first step is to group spending by department or activity. For example, are we paying too much for materials? Are we paying for 50 computer apps that nobody uses? Understanding these “cost drivers” changes the conversation from “let’s just stop spending” to “let’s fix this specific problem.” For instance, a restaurant owner might notice they throw away the most food on Tuesdays. Instead of buying less food all week, they can just adjust their orders for those specific days. By comparing their spending to other similar businesses, companies can see exactly where they are falling behind and where they can improve.

Smart Shopping and Working with Partners

The way a company works with its suppliers is a huge opportunity to save money that many people forget. Many businesses get lazy and just pay whatever bill they are handed. However, by checking contracts and talking to suppliers regularly, companies can save a lot of money.

One of the best tricks is “buying in bulk” to get a better price. Smaller companies can even join together to buy things as a group to get the same discounts as giant corporations. Another method is building strong, long-term friendships with main suppliers. If you are a loyal customer, a supplier is more likely to give you a discount for paying early. It’s also smart to have a few different suppliers for important items. This lowers the risk of running out and gives the company more power to negotiate because they aren’t stuck with just one person. Finally, letting suppliers know you are looking at other options keeps them competitive and fair.

The Human Side: Managing Staff Costs

Paying employees is usually a company’s biggest bill, so managing it carefully is very important. While firing people is sad and hurts the team’s mood, there are many better ways to save money while still getting the work done.

One smart idea is “cross-training,” where employees learn how to do several different jobs. This makes the team flexible so they can cover for each other when someone is sick or when things get extra busy, without needing to hire extra help. Offering flexible work, like working from home, can also save the company a ton of money on office space and electricity. These policies often make workers happier, which means they won’t quit as often—saving the company the high cost of finding and training new people. For businesses that are only busy during certain times of the year, offering people a voluntary break or “sabbatical” can save money without permanent layoffs.

Moving Faster with Better Processes

Slow and messy ways of working are like “money leeches” that suck away time and resources. By using “lean” programs to clean up these processes, companies can save money for years to come.

A great start is looking at every step of a job. Is there waste in the factory, the warehouse, or the office? “Lean” principles focus on making work flow smoothly and cutting out unnecessary steps. For companies that hold a lot of stuff in a warehouse, using a “Just-in-Time” system can help them buy only what they need right when they need it, which keeps their cash from being stuck in piles of extra boxes.

Technology is also a huge help. Boring, repetitive tasks like sending out bills or entering data can be done by computers (automation). This saves hours of work and prevents human mistakes. Using “cloud” services can also be cheaper than buying and fixing expensive company servers.

Smart Selling and Advertising

Marketing can be very expensive, and if you aren’t careful, that money disappears quickly. Saving money here isn’t about stopping ads; it’s about spending money where it actually works (this is called “Return on Investment” or ROI).

Old-fashioned ads, like those in newspapers, are expensive and hard to track. Online marketing is usually cheaper and lets you see exactly how many people clicked. By looking at the data, a company can stop spending on ads that don’t work and move that money to things like social media or Google searches that actually bring in customers. Also, keeping an old customer is much cheaper than finding a new one. By using loyalty rewards and great service, businesses can keep their current customers happy, which is a much more stable way to make money.

Building a Careful Culture

In the end, saving money only works if everyone in the company cares about it. Managers can make the plan, but the workers on the “front lines” are usually the first to see waste and have the best ideas on how to fix it.

To make this work, leaders need to be honest with the team about the company’s goals and why saving money matters. When employees understand the big picture, they start making better decisions every day. Giving different departments their own budgets to manage encourages them to act like owners.

It also helps to reward people for good ideas. Companies can start contests or give bonuses to employees who find clever ways to save. Having “open office hours” to talk about the company’s money helps everyone become more “financially literate” and makes the whole team feel like they are working toward the same goal.

Conclusion

Finding ways to save is a constant job for any business that wants to win. A great plan isn’t just about cutting everything; it’s a smart strategy based on data, good negotiations, and efficient work. By using technology to do boring tasks, spending marketing dollars wisely, and making sure every employee feels like part of the mission, a company can become much stronger. Cutting costs the right way isn’t about being in trouble—it’s about creating more profit and more cash to fuel future growth. It is a journey that never really ends, but the prize is a business that is faster, smarter, and more successful.